Token2049: Stripe’s debut shows the Web3 industry is heating up

Global payment leader is among the new players diving into crypto

GM,

It’s that time of the year again: we spent last week in Singapore at Token2049. The show is one of the most popular Web3 events, attracting a record 25,000 attendees this year.

In this issue, we’ll look at our three top takeaways from the show.

PS: You can catch up on our review of the show from 2024 and 2023

What’s going on?

We are back and refreshed after an intense but insightful week in Singapore at Token2049, an event that we’ve written about before and which we consider to be among the most important on the Web3 calendar.

Token2049 Singapore was paired with the Singapore Formula 1 race, as it is every year. That’s an association that raises prices significantly (hotels in Singapore already feel expensive for Southeast Asia, as it is) but it plays into the ‘yolo money’ side of Web3.

Big companies, investors and influencers have a natural play for the ostentatious, and F1 is the world’s most expensive and fastest sport, not to mention one of the most dangerous. It’s an apt pairing, for sure.

This year’s event saw the show take up the full five floors of the Marina Bay Sands convention center. The organizer claims 25,000 people attended, a new record by some margin for the already-popular franchise, and there were more than 600 side events to keep those without a ticket suitably occupied. ‘Token2049 Week’ was once again a carnival of Web3.

After hopping between dozens of meetings, coffee mornings, cocktail parties, fight nights, fireside chats, pickleball games and more, here are the biggest takeaways we took from the show.

SO WHAT?

1. Stablecoins are the hot topic

Stablecoins were the biggest talking point all week. That’s not a huge surprise given that the US passed the GENIUS Act to regulate stablecoins over the summer.

The act not only makes it possible for Web3 companies to set up shop in the US, something industry leader Tether plans to do for the first time, but it also provides a bridge for non-crypto companies to step into the industry.

That latter point was apparent at Token2049 just by looking at the major companies that took part in the event. Most obviously, Donald Trump Jr, the son of the US President, took the stage to discuss his stablecoin company, World Liberty Financial (WLF).

Issuing stablecoins is just the minimum: companies running with the ball are looking to offer new types of banking and financial services using these tokens. Increasingly, too, there are a number of companies that enable Web3 companies of any size to issue their own token. That allows them to enjoy yield, offer benefits to users, and have greater control of their treasury.

There’s been a proliferation of stablecoin-powered debit cards, with more than a dozen that have been backed by investors visible around the show. Some of the biggest parties were held by these companies, including Kast’s evening event which had more than 1,250 attendees on its RSVP list.

In parallel, the stablecoin industry is becoming more open than many had foreseen.

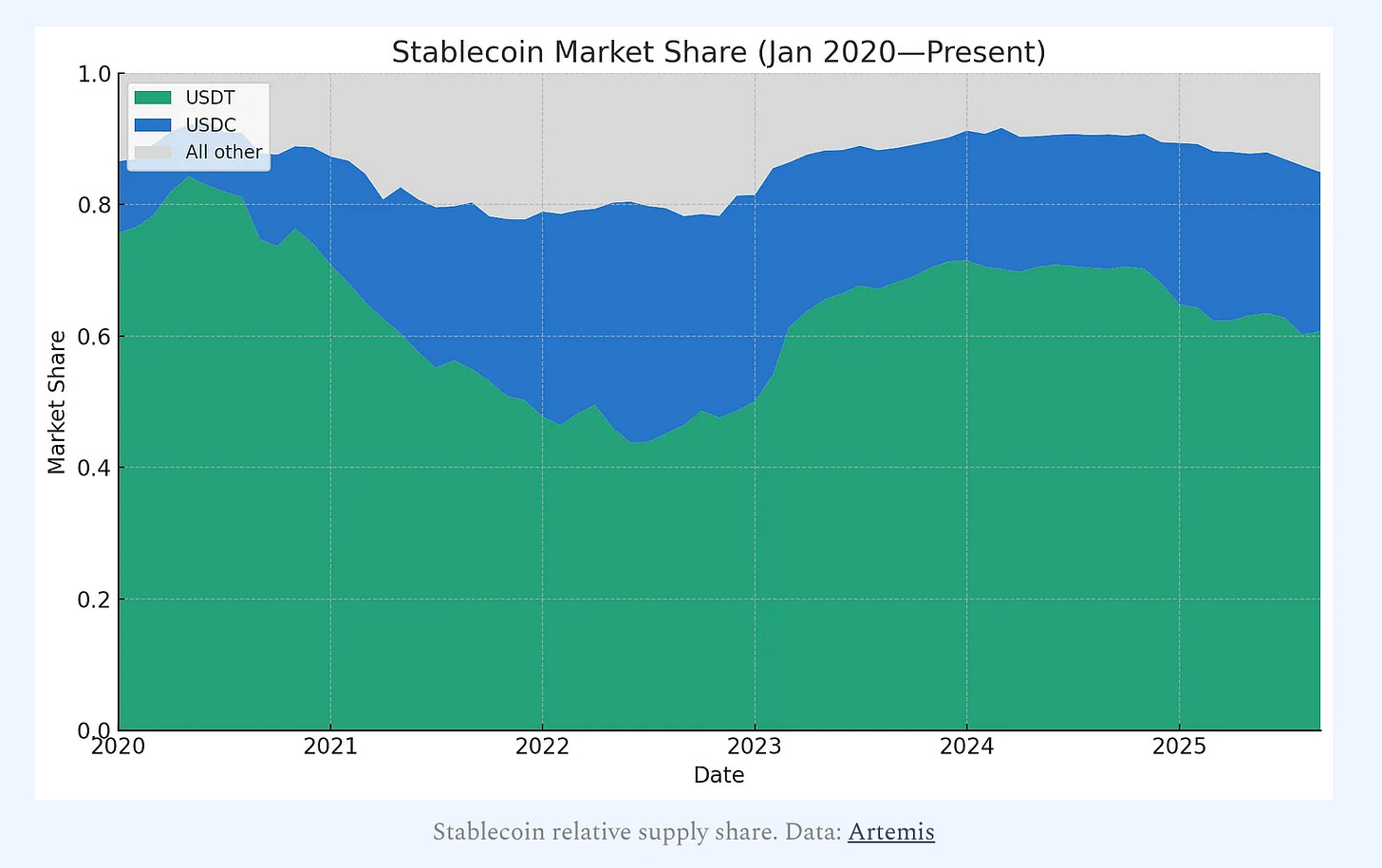

Analysis from Nic Carter, partner at Castle Island Ventures, shows the duopoly between Tether and Circle may be over. Or, at least, their dominance is declining as new entrants like WLF and smaller players powered by stablecoin issuers take up more ground.

Carter posits that this could usher in a more balanced future in which the big two do not completely own the space. Certainly, it is clear that neobanks are interested in taking parts of the Web3 experience, such as trading as Robinhood and Revolut have done. By the same token, no pun intended, Web3 fintech players are adding traditional banking services for on- and off-ramping.

We expect to see a lot more fintech and stablecoin activity at next year’s event, even if Singapore is a long way from Washington DC.

2. Stripe leads the payment pack

Traditional finance was not the only incumbent increasingly jostling for space at Token2049 in Singapore, tech companies were there in force: none more so than Stripe.

The payment giant attended the event for the first time this year. That’s a big deal but one that was expected since Stripe is a Web3 company now thanks to a flurry of activity which has included:

Acquiring Bridge, which helps manage stablecoins

Acquiring Privy, a crypto wallet platform

Accepting crypto payments after a 6-year hiatus

Launching a stablecoin issuance and management feature

Launching its Tempo blockchain for moving stablecoins globally

Typical of others at the event, Stripe had a strong presence at the exhibition and hosted a number of side events throughout the week. Yet its involvement is more than just another corporate showing. That’s symbolic of how the Web3 industry is expanding to include some of the most important players in global finance. Stripe’s mission has always been about building the economic infrastructure of the internet; now, that infrastructure includes blockchains, stablecoins, and on-chain identity.

Stripe wasn’t alone. Mastercard, Visa, and several global banks were also present in Singapore, many of them sponsoring side events or quietly meeting with startups to explore partnerships. The difference this year was intent: these companies weren’t just sniffing around for PR or experimentation; they were scouting infrastructure, compliance tools, and potential integrations.

That convergence between Web2 and Web3 was one of the defining undercurrents of Token2049. It’s becoming harder to tell where fintech ends and Web3 begins. Custody startups are acting like banks, banks are experimenting with tokenized deposits, and payment companies like Stripe are turning crypto from an add-on into a core product line.

Stripe’s appearance in Singapore didn’t just underscore that trend, it confirmed it. The world’s largest payment rails are no longer watching from the sidelines. They’re joining the show, quite literally.

3. Asia remains the world capital of Web3, for now

We say it every year when we wrap up the show, but Token2049 again illustrated that Asia is at the center of the Web3 focus, and maybe Singapore itself is the eye of that storm.

That may seem counterintuitive given the inauguration of President Trump, who many in the industry are calling the first crypto President based on his policy approach and advisors. It is undeniably true that the US is opening itself to Web3 like never before, but that hasn’t seen it leapfrog Asia just yet.

That may be because it takes time for processes and companies to bear fruit. Tether and others that have announced stablecoin launches are still yet to come to market.

But Asia retains the attention because it has an existing and captive audience, whilst governments across the region are racing to follow suit with the US, although many made moves before Trump entered the White House for the second time this year.

That was reflected in the attendance of Token2049 which rose again this year, from 20,000 last year, with many being part of the Singapore event for the first time. Beyond that, we met people for whom this was their first trip to Singapore, let alone Southeast Asia. Many in that latter bracket are located in the US.

Asia’s position as the world’s lead Web3 market is certainly under threat, however.

Not only is Trump’s America friendlier to the industry than ever before, but the Middle East is also becoming a destination, and a serious one at that. The region had traditionally been seen as brash, awash with capital but little credibility.

That’s changed over the past year, at least, as credible projects, investors and other high-profile figures moved to the Middle East either permanently or semi-regularly. Those we talked to explained that the appeal is no longer just access to capital, but Web3-centric laws and regulations, a growing community and access to talent. Those are compounding factors that only serve to increase the Middle East’s significance.

Asia remains on top. But Token2049 reminded us that the center of gravity in Web3 can move faster than anyone expects.

News bytes

Fintech PayPay, which is backed by SoftBank, acquired a 40% stake in Binance Japan with a view to integrating their two services

YZi Labs, a now independent investment firm that was previously owned by Binance, announced a new $1 billion fund that’s focused on Binance’s BNB ecosystem

Coinbase has launched its decentralized exchange (DEX) in the US market as trading continues to shift away from centralized platforms

Predictions market platform Polymarket raised $2 billion from the parent company of the NYSE at a $9 billion valuation

We wrote about predictions market last year, and there’s clearly money flowing as Polymarket’s CEO confirmed it closed two funding rounds: a $55 million round at a $350 million valuation last year, and a $150 million round at a $1.2 billion valuation this year

That’s all for this week!

Share your feedback, questions or requests via email to: sowhat@terminal3.io