Prediction markets have blown up around the US election—are they here to stay?

More than $1 billion has been bet on the US election, despite platforms being banned in the US

GM,

More than $1 billion has been wagered on the 2024 US election using a Web3 service that could break out into the mainstream. That figure is impressive, but it is even more notable considering the platform in question, Polymarket, is banned from offering bets on US soil.

Welcome to the wild world of prediction markets. Betting on politics is a murky business in the US, where it is mostly illegal, but that could soon change following a landmark ruling this month. Still, that hasn’t stopped the nearly $500 million in transactions that flowed through Polymarket in August.

Prediction markets have blown up around the election—are they here to stay?

Best,

Jon and Gary

What’s going on?

“The first prediction markets election.” That’s the title prominent online media outlet Axios gave to an article published this month after Kalshi, a leading prediction market platform, got the go ahead to offer predictions on the US election to users on American soil.

Politics and mainstream attention are notoriously difficult to read. Look at Brexit, Trump’s maiden win and more. The prediction markets are not mainstream yet, but there’s more than $1 billion in cryptocurrencies currently stake on the outcome of the election alone, let alone sub-pilots around debates, government policy and the remainder of President Biden’s tenure.

Prediction markets may not be embraced by all, but they’re new and exciting and frightening real-time. In a society with a low attention span that demands instant-gratification, it is perhaps no surprise that they’re attracting attention. But the rise of predictions hasn’t arrived overnight—and it isn’t likely to fizzle out in a short timespan either.

SO WHAT?

1. Naturally suited to Web3

A common criticism levied at cryptocurrencies is that investments in them are tantamount to gambling.

Memecoins, which we looked at in a post in April, are a microcosm of that. Memecoins mirror popular culture and internet trends, and, since they offer no utility, are certainly quite like gambling. But prediction markets take that to a whole new level by allowing users to take bets on any prediction that can generate enough interest to hold a market.

This isn’t the same gambling you find in a betting shop.

Prediction markets are situations with binary outcomes

A token is created for each outcome which a speculator can buy

The outcome is priced dynamically according to demand and probability

When a prediction is closed, the correct token pays out at $1

But users can sell their prediction at any time

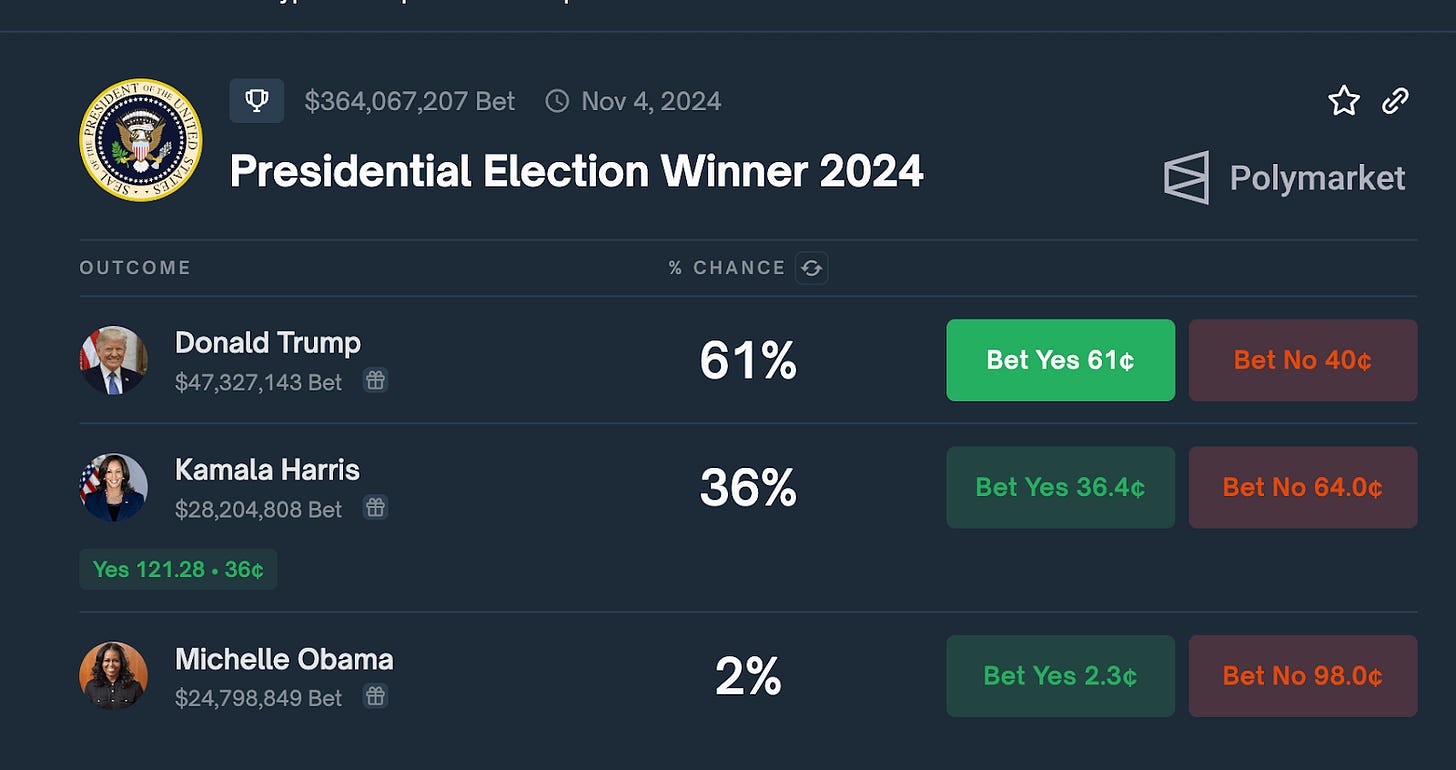

In the example below from Polymarket, bidders can bet on Trump, Harris or other candidates winning or losing the 2024 US President election.

Firstly, the amount bet has nearly tripled since July.

But also, the prediction odds change so speculators can make money by trading the market difference. Harris, for example, was at 36% in July—so speculators could now make money simply trading the odds change over that period.

Polymarket is the best-backed in its space, having raised $70 million from investors that include PayPal co-founder Peter Thiel’s Founders Fund, General Catalyst, Airbnb co-founder Joe Gebbia and Ethereum creator Vitalik Buterin.

One of the big things to note is the total bet on the US election prediction has risen significantly during that period, going from nearly $365 million to $851 million in less than two months.

“The first prediction markets election?” Maybe—but what’s more certain is that this is just the start of the journey in the US.

2. Regulate or go offshore

Polymarket might have racked up more than $800 million in bets on the US presidential winner (there’s a separate prediction for the popular vote—which has very different odds) and generated nearly $500 million in transactions in August, but the platform is banned from the US.

In January 2022, Polymarket was fined $1.4 million by the US Commodity Futures Trading Commission (CFTC) and ordered to shut down unauthorized markets. The CFTC argued Polymarket offered unlicensed “event-based binary option contracts” but it didn’t explicitly forbid the notion of betting.

That’s important because, fast forward to this last week, and the aforementioned Kalshi—Polymarket’s main rival—just got the green light to go-ahead and offer US political predictions in the US. That’s something neither Polymarket nor older rival PredictIt can do.

Kalshi’s approval comes with caveats:

It won an appeal after the District Court of Columbia ruled it should be allowed to list political contracts ahead of the election

That’s in response to the CFTC last year banning political event contracts as they are “contrary to the public interest”

But the CFTC has appealed this new decision, which is paused for 14 days while the judge files her opinion

Kalshi plans to launch a regulated exchange early next year that will enable “an asset class that meets the demands of today’s information economy”

The fight is not over as the CTFC proposed earlier this year to ban contracts that bet on the outcome of political activity

It’s important to note, too, that Kalshi has a very limited set of predictions as compared to Polymarket. It doesn’t focus on sports betting, for one, and its political market hasn’t arrived yet as its battle with the CFTC remains ongoing, albeit at the final appeal stage.

PredictIt, an older prediction markets rival, had operated under a ‘no-action letter’ issued by the CFTC in 2014 until it was withdrawn in August 2022, the same year the agency went after Polymarket—the two are engaged in a legal battle today

That explains why Polymarket is, for now, limited to offer its platform to users based outside of the US. However, conversations on platforms like Reddit and X indicate that many US-based speculators simply access the site using a VPN. That’s an issue which has caught the CFTC’s attention, however.

“We are observing any activity that’s occurring offshore and providing exposure to US customers,” chairman Rostin Behnam said this week at a conference.

Unlicensed access would explain the significant volumes that Polymarket receives. Kalshi’s ongoing progress may help change the game for its rivals such as Polymarket and bring regulated political predictions to the US.

3. Living on beyond the election and media tie-ups

The impact of these platforms is not reliant on regulation, however. Already they are becoming data for political analysis and coverage from the media. Unlike polls and surveys which can be limited in reach and with unclear motives, critics argue that prediction markets are more accurate as those betting have skin in the game and a single incentive with their prediction.

Bloomberg this month added Polymarket predictions to its Terminal, a hub for up-to-date market trading information and news, and channels like CNBC have plugged Polymarket as a reliable source. Right now, neither looks like monetization but it could throw light on future alliances.

There’s no doubt that the election has been a game-changer for prediction markets, and Polymarket in particular. On-chain analysis has shown that election-related predictions account for the lion’s share of its business this year, as Web3 investor Richard Chen noted on X.

Beyond the top figures, Chen provided further data which showed that Polymarket’s top two markets—predicting the election winner and the democratic nominee—account for half of the platform’s all-time volume.

Polymarket counts political writer and statistician Nate Silver among its advisors.

There’s no doubt that Polymarket is pushing the election as its hot moment—despite being barred from serving the US audience—so it remains to be seen whether this will be its breakout moment, or whether it will return to previous levels once the President is decided.

One interesting development that could signal its likely future is indeed around the media. Word has it that Polymarket is focusing on building out its editorial capabilities by hiring journalists to write articles or potentially build out a larger media business.

That makes sense because not only is the media in a state of flux that has seen plenty of talented journalists leave the industry, but developing a content strategy could help it reach new users and engage its existing audience beyond the election. By contrast, SO WHAT understands that some media entities are also exploring ways to bring prediction markets into their product.

Predictions are usually open-close but the third-party oracles can be required to adjudicate in controversy. Robert F. Kennedy Jr.’s decision to suspend his campaign in August is one such example. Despite his announcement, he will contest some states and continue to receive donations. Polymarket paid out predictions that he’d drop out.

That makes sense because media is notoriously difficult to monetize—hence journalistic talent departing—and predictions could represent an unobtrusive way to monetize articles in the future. That’s dependent, however, and finding the right blend and not stuffing predictions into irrelevant articles and ensuring the editorial focus isn’t compromised by the day’s biggest predictions.

Prediction markets may dwindle following the election, but they’re likely here to stay and we should expect to see more experiments with the media particularly if prediction platforms go legal in the US.

News bytes

Former President Donald Trump launched a crypto project called World Liberty Financial—details are vague but it will offer lending/borrowing on Ethereum (Trump continues to associate his candidacy with a pro crypto stance)

JPMorgan chief Jamie Dimon says his firm is likely one of the biggest users of blockchain technology—but it uses the ledger and data side rather than cryptocurrencies

Singapore’s DBS Bank will launch OTC crypto options trading and structured notes for its institutional clients in the near future

Circle has integrated its USDC stablecoin with the national payment systems of Brazil and Mexico to enable usage from businesses and others—it also announced a new global HQ in New York, potentially to set it up for a much-anticipated IPO that will shed new light on the business of issuing stablecoins

Stand With Crypto, a political advocacy group led by Coinbase, launched a legal defense fund worth $6 million that will support NFT projects targeted by US regulators

In related news: NFT project Flyfish Club agreed to pay $750,000 as part of a settlement with the SEC over selling unregistered securities—the project raised nearly $15 million between August 2021 and May 2022 to develop a restaurant and bar that are set to open this month

That’s all for this week!

Share your feedback, questions or requests via email to: sowhat@terminal3.io