The SEC is finally going to regulate cryptocurrencies with clarity

Crypto-friendly executives are tasked with ending the regulatory uncertainty of the Gensler era

GM,

It didn’t take long for the Trump administration to cause chaos in Web3. It happened before the President even took office—as our readers will likely know, Trump launched his own “official” cryptocurrency—which became the fastest-growing memecoin, rocketing to a high of $16 billion. He promptly launched a similar coin for his wife 24 hours later.

Despite this unorthodox moment, the first week of the new administration has yielded a tangible piece of news: the SEC has revamped its focus on Web3 with the formation of a new “Crypto Task Force.”

Best,

What’s going on?

“The SEC can do better.”

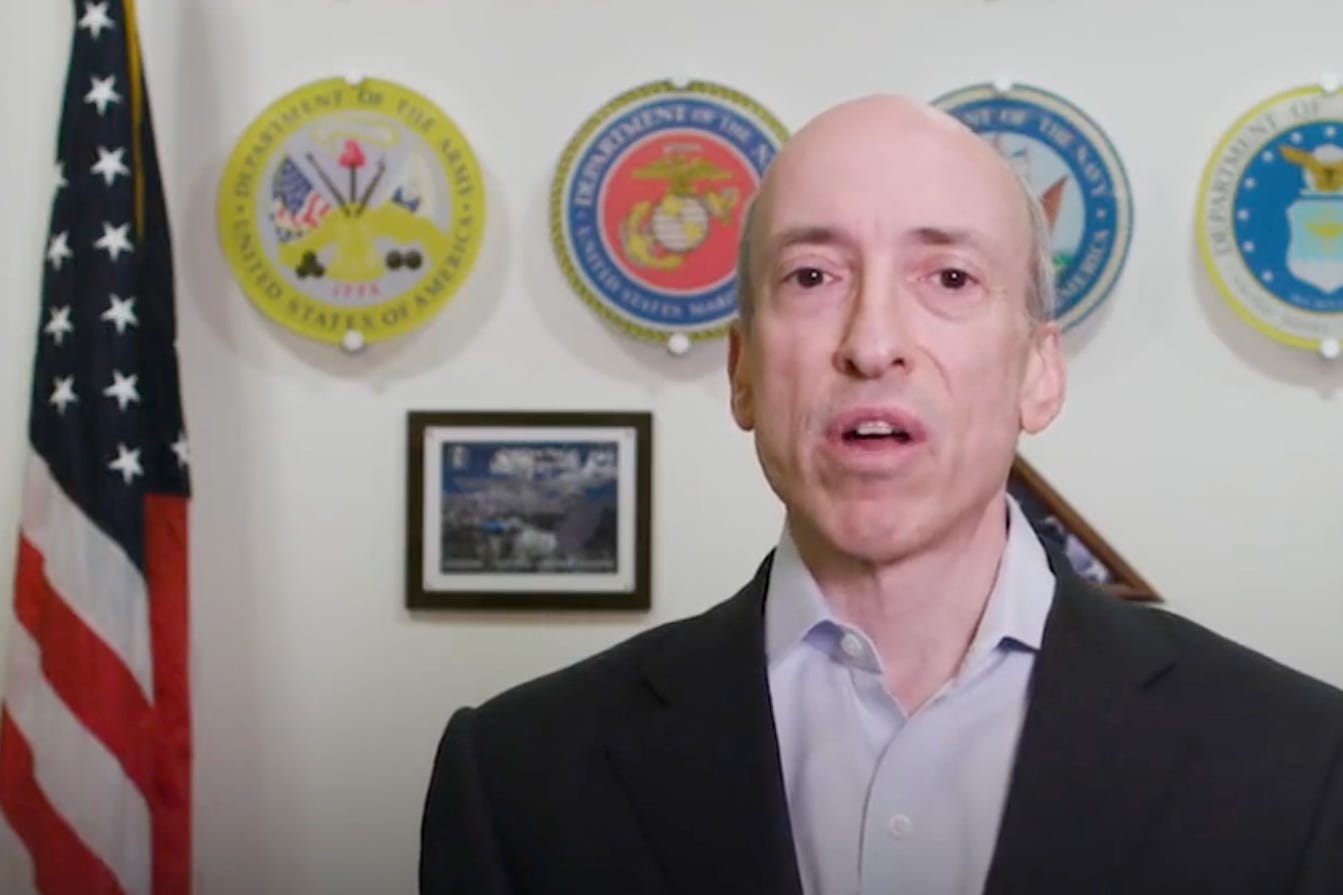

You don’t often see bureaucrats throw their peers or seniors under the bus, but the announcement of “SEC Crypto 2.0” has some scathing words for the previous administration’s approach to Web3, and by association its former head Gary Gensler.

Gensler’s approach of using enforcement created “an environment hostile to innovation and conducive to fraud,” the announcement noted. It criticized the approach for failing to bring about clarity.

Instead, the new approach promises to usher in a new era of regulatory and legal clarity. If that comes to fruition it will not only benefit the US and those in the Web3 industry, but other countries may follow suit.

Let’s dig into the details.

SO WHAT?

1. A new clear and sensible approach

The Gensler-era SEC was marked by inconsistency and a lack of clarity around regulation.

Gensler took a tough stance on Web3 projects, pursuing legal action against companies that include Coinbase, Binance and others. Coinbase, in particular, argued that they needed clarity. He was criticized for regulation by enforcement.

Ultimately, the SEC is stepping up now because the Gensler regime left unresolved issues between the industry and the regulator, even before Trump lit the fire by introducing his own memecoin. Rather than treating Web3 as a new asset, his tenure was marked by a determination to classify digital assets using the same frameworks as regular investment products—and a continued focus on defining cryptocurrencies as securities.

The gap was so pronounced that the US risked losing out on the Web3 industry altogether. US companies looked to other markets with more coherent frameworks, including the EU, Hong Kong and Singapore, in order to find greater certainty.

“The Task Force’s focus will be to help the [SEC] draw clear regulatory lines, provide realistic paths to registration, craft sensible disclosure frameworks, and deploy enforcement resources judiciously,” read the announcement.

That’s exactly what US companies, many of which had resorted to considering overseas relocation, wanted to see. More than that, it may encourage a new cohort of future founders to decide to base their Web3 business in the US. That in turn could benefit the US economy, and take a big step towards bringing the type of innovation that’s within Web3 on the technical side—such as decentralization, blockchain transparency, and online currencies—into the mainstream.

2. A very different looking team

The task force has been set up to assist the SEC—a number of its staff are particularly notable for their criticism of the previous regime’s agenda:

SEC Acting Chairman Mark T. Uyeda—launched the task force

Commissioner Hester Peirce—will lead the task force

Peirce, in particular, is well regarded within the Web3 industry where she is affectionately referred to as ‘Crypto Mom.’ That’s because she has consistently spoken out with criticism of the SEC’s approach to Web3 regulation.

A former lawyer, Peirce was the obvious candidate to pick the task force up. She has a history of almost pleading for a change-of-course within the SEC, and you’d imagine that she enjoyed some heated conversations with Gensler since stepping into the SEC in 2020 as an appointee of President Trump.

Peirce said in May 2022 that the SEC had “dropped the ball” on regulating crypto which enabled “a lot of fraud”.

One month later, Peirce doubled down:

“Watching the SEC refuse over the past four years to engage productively with crypto users and developers has prompted feelings of disbelief at the SEC’s puzzling, out-of-character approach to regulation,” she said.

There’s little doubt that Peirce will relish a role and responsibility that has been years in the making for her.

Then there’s Uyeda who has stepped into Gensler’s shoes on a temporary basis following his exit and the planned appointment of Trump nominee Paul Atkins to the role full-time. Like Peirce, Uyeda has been a dissenting voice on Gensler-led crypto policy for some time.

The two commissioners voiced their disagreement at the end of 2023 when the agency denied a petition by Coinbase to add crypto to its rulemaking agenda.

Meanwhile Atkins, a former SEC commission who would ultimately sign-off on the task force’s proposals and regulatory recommendations should his nomination carry, has spoken out against Gensler’s approach and worked with Web3 firms and crypto lobbyist groups. The CFTC, which works in tandem with the SEC, also got a new head who is also prioritizing clarity over digital assets.

3. It will take time and may not be universally ‘good’ news

The mandate and the team couldn’t be more different to the previous SEC regime, but still expectations among the industry should be tempered.

Devising and implementing regulatory policy doesn’t happen overnight and, whilst many of the key figures are seen as ‘crypto friendly’ and clarity is sorely needed, that doesn’t equate to some kind of crypto utopia.

Expectation around Trump’s own position on Web3 has also been reset during his first week in office. The President said he didn’t know much about the coin and hadn’t checked it, when asked this week about the soaring value it had reached.

Whilst he would be right to be coy given the ethical backlash and potential regulatory breaches that the launch has brought to him, it does seem he has little awareness of the project. It, and other Web3-related projects, got no mention during his inauguration speech, despite plenty of rumors circulating prior. Similarly, none of the Executive Orders signed on his first day related to Web3 which disappointed expectant industry leaders.

The fact that Trump even launched the coin, and then one day later another for his wife Melania, has undermined his label as a ‘Bitcoin President.’ Bitcoin and memecoins don’t mesh together easily, as we’ve written previously.

As we wrote last week, there is a lot of uncertainty around Trump’s second term and particularly whether the big talk on policy, regulation and other Web3 topics will result in tangible changes. The task force, whilst just an announcement, is perhaps the punchiest move Trump could have made this early—and it could inspire other nations to follow suit and reassess their own approaches to Web3.

News bytes

Taiwan is reportedly planning a law that will allow banks to issue stablecoins for the first time

Trump pardoned Ross Ulbricht, who created dark web selling platform Silk Road and was jailed to life in prison in 2015

Thailand could become the next country to launch Bitcoin ETFs

Popular prediction market platform Polymarket has been banned in Singapore with Thailand ready to follow suit

Telegram has made TON its exclusive blockchain for mini apps, meaning all mini app developers must build on the platform

Meanwhile Line has followed Telegram’s playbook by launching its own decentralized apps for users of its messaging service

That’s all for this week!

Share your feedback, questions or requests via email to: sowhat@terminal3.io