The past, present and future of Bitcoin’s new and exciting developer landscape

Bitcoin is scaling, connecting and now even memecoin’ing with the rest of Web3

GM,

Bitcoin, Bitcoin, Bitcoin. The upcoming halving is all that Web3 is talking about—although the crazy weather in Dubai, where the latest Token 2049 event is happening, is not far behind.

Halvings tend to be a tense affair. Past events have been preceded by a sizeable drop in Bitcoin price in the months leading up and general negativity, This time around, the price drop is smaller (less than 20%) and there’s noticeably more positivity due to new factors: Bitcoin ETFs, which have unlocked $100 billions in new trading volume, and excitement around newfound utility of the Bitcoin blockchain.

We’ll have more on the halving next week—this issue focuses on what is making developers get excited about Bitcoin.

Best,

What’s going on?

The next Bitcoin halving is just days away. This event is a pivotal moment for Web3 since it represents the halving of the rewards for miners who mine new Bitcoins and process transactions. That’s important because Bitcoin is the most popular and decentralized network—the fact that Bitcoin’s ownership model is so broad makes it Web3’s most secure blockchain.

Aside from being the first cryptocurrency, Bitcoin’s simplicity made it appealing. Bitcoin was designed to be a global, digital alternative to centrally-controlled economies, according to the whitepaper pushed by Satoshi Nakamoto in 2008.

The arrival of Ethereum in 2015 ushered in a new era of developer platforms and decentralized applications (dapps) such as DeFi. Bitcoin seemed to fall behind. But a resurgence over the last year—fueled by expectation and launch of ETFs—has seen an increase in developer focus on Bitcoin which is likely to impact the landscape post-halving.

SO WHAT?

1. First came scaling

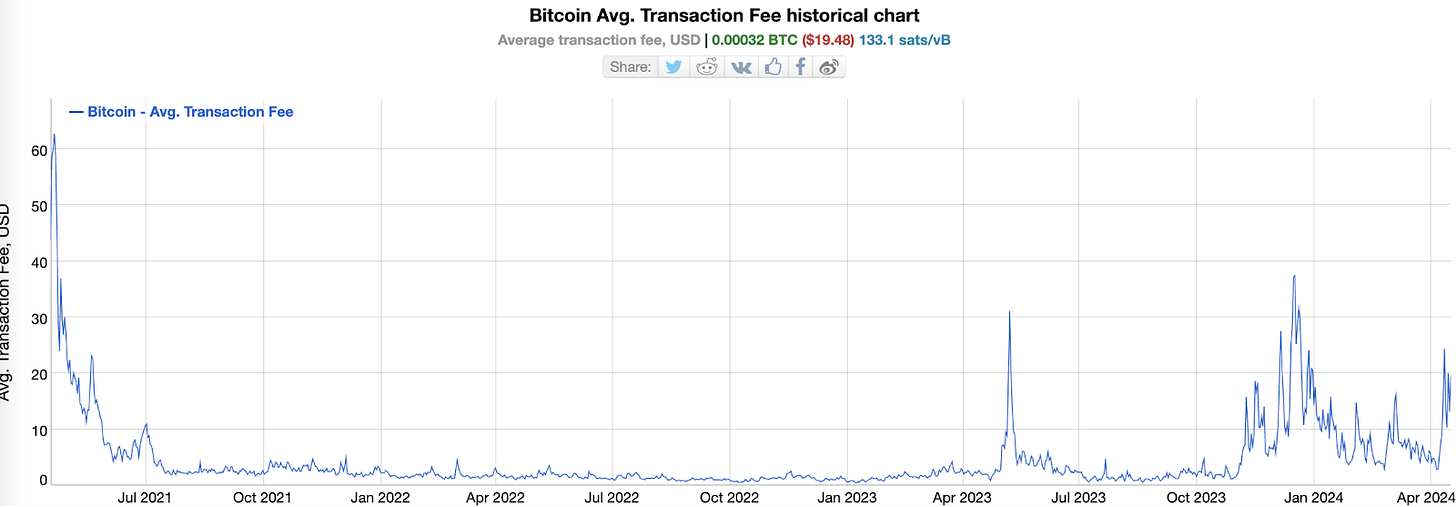

Bitcoin has a scalability problem. It was designed more than 15 years ago when common concepts like cloud computing and mobile apps were nascent concepts. Due to its architecture, Bitcoin is limited to fewer than 10 transactions per second and at significant cost. Gas fees have averaged around $20 per transaction over the last three years, but during peak activity they can top $50 and take more than 30 minutes to be processed.

That’s the core issue layer-2 networks aim to fix. Using the same principles as layer-2 solutions on chains like Ethereum, pioneers like Lightning Network, Stacks, Liquid and Rootstock claim to significantly increase transaction per second (TPS) and complete transactions nearly instantly. Gas fees are reduced to less than $1 through these solutions, which, in simplified terms, process individual transactions on a second network away from the Bitcoin blockchain and subsequently update the record on the Blockchain ledger in batches.

Speedier and cheap transactions are key to enabling more advanced services on the Bitcoin network, such as DeFi, games and social networks. Opening up the potential of more advanced services and utility to be built on Bitcoin can increase transactions and create new demand that hasn’t been seen around the time of previous halvings.

2. Then came connecting

Companies aren’t just attacking Bitcoin’s scalability limits, others are directly facilitating the type of advanced apps and utility that are commonly found on chains like Ethereum, Solana and Comos.

Investors are diving into new startups that can bring utility to Bitcoin, notable deals include: Mezo (raised $21 million to enable DeFi on Bitcoin), Bitlayer (raised $5 million to become a computational layer on Bitcoin), Build On Bitcoin (raised $10 million connect Ethereum dapps to Bitcoin), Bitfinity (raised $7 million to grow a Bitcoin scaling network built on the Internet Computer protocol) and Babylon (raised $18 million to enable Bitcoin staking.)

These companies have not launched products to the public, but already omnichain networks are connecting multiple blockchains, including Bitcoin. They include the likes of LayerZero and ZetaChain (disclosure: Jon is a contributor), and they enable dapps that exist on other chains to tap into Bitcoin for more users, increased liquidity and other benefits.

Moving funds from Bitcoin to Ethereum, for example, is cumbersome today. The solutions are bridging the assets, which can be expensive and take a long time, or using wrapped tokens which represent the Bitcoin asset. Omnchain blockchains facilitate a direct asset transfer at a far lower cost. The idea is to allow Bitcoin holders to put their asset to use in DeFi, games or other areas and enable developers to tap the vast base of Bitcoin holders.

It remains early days but the emergence of tools and plumbing to bring apps to Bitcoin and enable Bitcoin to travel to Web3 apps is another factor that hasn’t existed at the time of previous halvings.

3. Now comes the memecoins

Looking into the future, Bitcoin looks poised to become a lot more active based on a new token standard that is launching alongside the halving: runes.

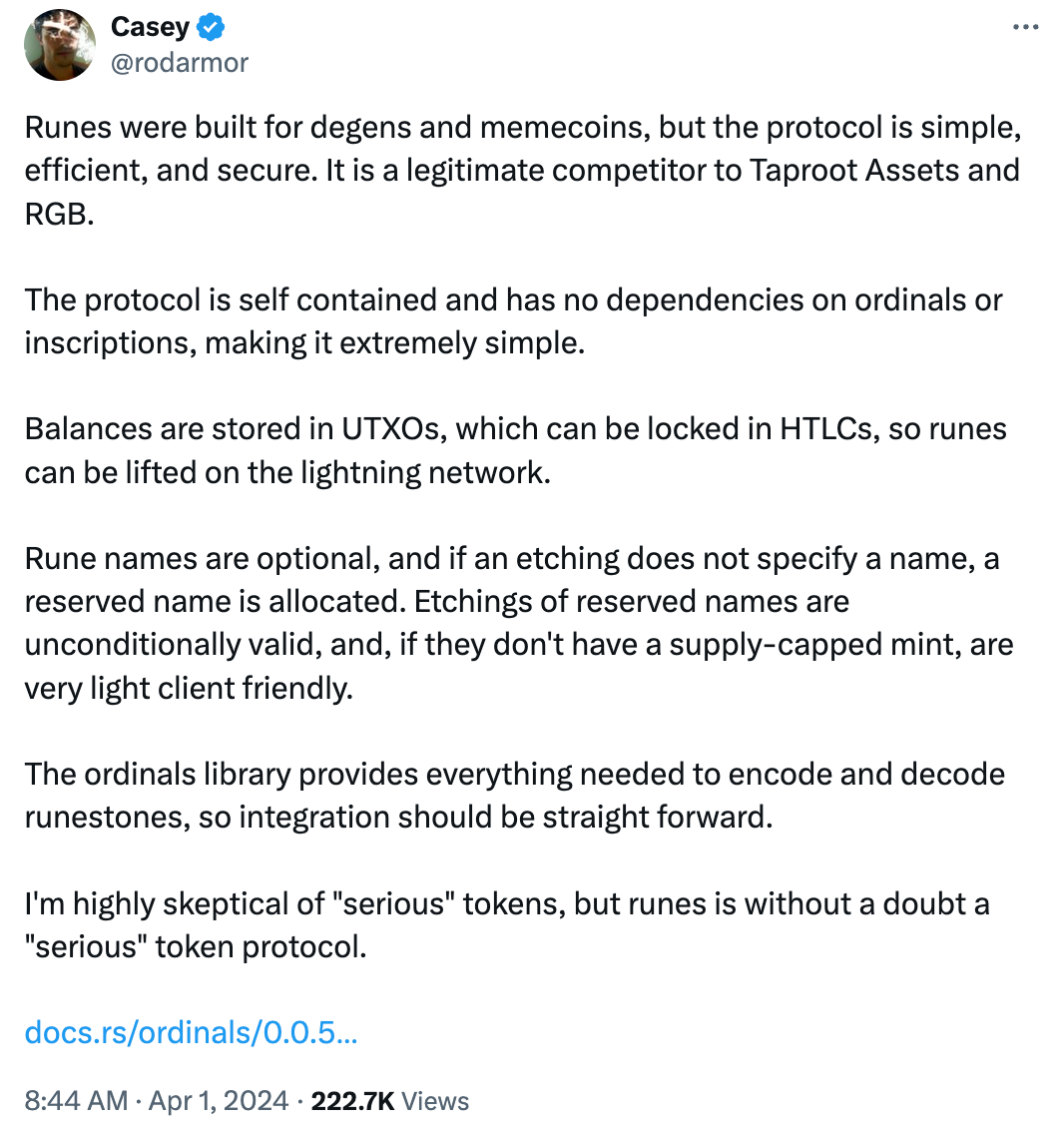

Runes is a new protocol to create fungible tokens on the Bitcoin blockchain—that means Bitcoin could host memecoins and other community-based projects which are currently not supported. The creation is the brainchild of Casey Rodarmor, the developer who developed Ordinals to bring NFTs to Bitcoin, and it could enable the type of memcoin push that has been seen on Solana, Coinbase’s Base Network and elsewhere this year.

Rodarmor’s creation of Ordinals brought plenty of controversy to Bitcoin, where many “maxi” enthusiasts believe Bitcoin’s sole objective is a digital alternative to fiat currency. Runes is likely to provoke an even stronger reaction given how divisive memecoins themselves can be—most operate much like a casino bet with a real risk of losing money.

Purely from a Bitcoin activity perspective, however, Runes looks as though it could be transformative. When we wrote about memecoins recently, we pointed out that they have become an important part of marketing and user activation for blockchains simply because they drive attention, interest and adoption. A number of blockchain companies have dedicated teams to help conceptualize, launch and find success with memecoins. Bitcoin has never had a problem with adoption relative to the rest of Web3 as it is typically the gateway for new users, but this activity could help it to reach a broader audience and generate more transactions and interactions.

Bitcoin looked like ‘Boomer Coin’ a few years ago, but a glut of new activity and potential for more could mean that this coming halving is far less pessimistic than any we have seen before. Don’t miss out on our issue next week delving into that in greater detail.

News bytes

Worldcoin, the digital identity project co-founded by Sam Altman, plans to launch its own blockchain in the summer to enable apps to piggyback its proof of personhood

Hong Kong’s ETF applicants claimed they’ve won approval but there’s been no official confirmation from the Securities and Futures Commission yet—these ETFs are tipped to be far smaller than the US ETFs but still a significant moment for Bitcoin adoption

Hong Kong police have made 72 arrests and seized HK$228 million (US$29 million) in frozen assets following an investigation into the JPEX cryptocurrency scandal last year (more on that below)

Binance has finally won a crypto license in Dubai after former CEO Changpeng Zhao conceded control of the local unit—Binance is also tipped to pay a fine to reenter the Indian market

The US IRS says it is becoming more aggressive on crypto tax crime cases going forward

That’s all for this week!

Share your feedback, questions or requests via email to: sowhat@terminal3.io

A very good analysis of the past, present and the future. I’m please that our thoughts on Ordinals are in tandem to each other. Just yesterday on the Cryptofada research we published about Runes Protocol by the Ordinals founder and it therefore apparent that the future is here. Nice job guys!!!