How Hyperliquid built the first killer decentralized trading platform

Viral traders and strong community key to $13B in daily volume

GM,

It takes something special to worry Binance, the crypto trading juggernaut with a near-40% market share, but Hyperliquid, a pioneering decentralized rival, ruffled its feathers earlier this year.

Hyperliquid has become the biggest platform for perpetual trading in crypto—that’s what worries the big boys of the industry—and it did it without any investment from VCs. Zero. Instead, it rewarded its users with an airdrop worth billions.

Hyperliquid is redefining the playbook for building Web3 companies, and now it is catching the attention of those beyond crypto. This week we dig into why and how.

Best,

What’s going on?

Centralized exchanges are tolerated rather than loved in the Web3 industry.

A number of Binance users sued the crypto exchange in 2021 alleging that they had collectively lost tens of millions of dollars due to outages on the platform. There are plenty of incidents including a trader losing $3.7 million due to a Binance rule change and, of course, users losing their assets when platforms like FTX abruptly shut down.

Crypto startups can be at risk if their tokens are delisted. In the case of Mantra, which we wrote about recently, it alleged that “reckless forced closures” on centralized exchanges wrecked its token price.

Hyperliquid has changed the game by enabling a trading experience that’s as fast as on Binance, Coinbase and other centralized platforms but with the freedom and transparency of decentralization.

Leveraged trading, in particular, requires trading speed and platform uptime, which has raised issues on centralized platforms in the past.

SO WHAT?

1. The decentralized concept

Decentralization is the core concept behind the Web3 movement. Principally, users should be able to own their assets themselves without reliance on a third-party. That applies to assets like cryptocurrencies, artwork like NFTs, and even user data.

The clearest example of that is in self-custodial wallets, which enable direct ownership of cryptocurrencies like Bitcoin or Ethereum. Using self-custody, owned assets can be accessed at any time without the need for a centralized entity’s permission. The obvious benefit is your assets are not lost if a company becomes insolvent or steals deposits.

Decentralization struggled as a concept for some time because trading and swapping was limited to centralized exchanges that didn’t support self-custodial wallets.

The launch of Uniswap, the first truly decentralized exchange (DEX), in 2018 was a major step forward but its functionality was limited. Advanced trading such as perpetuals—which lets traders speculate on future prices—were usually made on Binance or Coinbase, which had deeper liquidity and greater trust among traders.

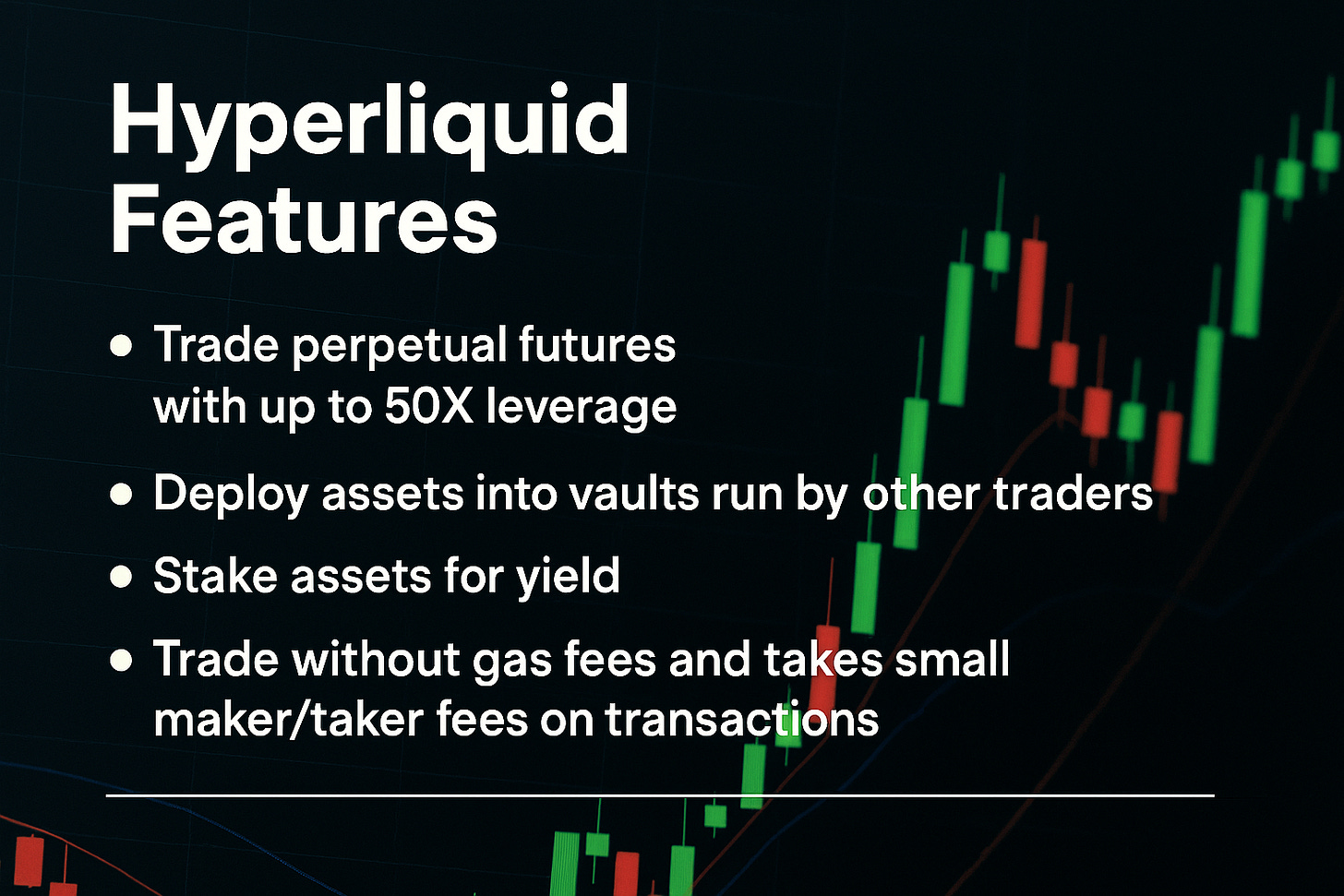

That changed, however, when Hyperliquid established itself in late 2024. The decentralized platform lets traders:

Trade perpetual futures with up to 50X leverage

Deploy assets into vaults run by other traders

Stake assets for yield

Trade without gas fees and takes small maker/taker fees on transactions

That’s turned Hyperliquid into the largest on-chain perpetual trading platform, with over $13 billion in daily trading volume.

Hyperliquid overtook the top perp DEX Dydx rapidly, but its numbers are still well behind market leader Binance’s $62 billion daily futures volume—from a centralized product. But it’s impressive for a product that only established itself six months ago and with a very unique proposition.

Binance certainly sees Hyperliquid, and the potential of sophisticated DEXes, as a major threat to the dominance of its business.

That came to a head in March 2025 when Binance appeared to take advantage of suspicious market activity around a memecoin called Jelly Jelly to force a liquidation that could have caused Hyperliquid’s main liquidity vault to lose millions of dollars.

Ultimately, Hyperliquid stepped in to settle its trade at a more advantageous price, which raised concern that it is not fully decentralized. A number of centralized exchange executives criticized the platform for creating systemic risks for users and not being fully decentralized as it claims.

2. Community, not investors

Hyperliquid survived that rocky episode around Jelly Jelly thanks to the strong community that it has built since it launched its token in November 2024.

Its rise is marked by a very different approach to financing and launching the platform. Hyperliquid decided against raising venture capital, and instead decided to incentivize early users with an airdrop—we’ve written about airdrops before and they’re key to marketing a token launch.

But this was no ordinary airdrop. It was the largest of all time. Hyperliquid gave $1.6 billion worth of its HYPE token to more than 90,000 users that had traded on its platform since its initial launch in 2023.

That was 31% of all HYPE tokens—far more than the typical 5-10% seen at most launches. The average airdrop amount was worth over $9,000, with biggest allocations running into millions.

By not taking money from VCs, Hyperliquid mitigated the risk that some of its earliest investors would sell large portions of their token allocation once it launched and trading went live. Instead, early users held onto most of their tokens.

Their loyalty was rewarded as the token price has risen from $3.20 back in November to over $40 in early June.

Community has been a key part of its development as Hyperliquid has tapped the social side of Web3.

It has a leaderboard of traders, and many of its most active users share referral codes and flex their trades directly on Hyperliquid. Indeed, this year’s most notorious trader—who goes by James Wynn—has conducted a series of aggressive trades on Hyperliquid, including losing nearly $100 million by trading Bitcoin perps.

The buzz around Wynn’s wild trading is one of many that has helped cement Hyperliquid as the place for experienced traders.

3. Appealing beyond Web3 and facing regulators

The charge of the HYPE token has pushed Hyperliquid beyond the Web3 and crypto Twitter community and into the view of the financial world.

Eyenova, a NASDAQ-listed firm that specializes in eye health tech, bought $50 million of HYPE to build a “strategic treasury.” One week earlier, Singapore’s Lion Group Holding—which also trades on NASDAQ—announced that it will launch a $600 million treasury fund anchored by HYPE.

The token has become synonymous with decentralized trading, while its spectacular returns over a short period of time—during a period in which traditional institutions are embracing Web3—makes it an obvious target for some enterprises.

Hyperliquid has also moved to be part of mainstream conversations. In May, it submitted formal responses to the US Commodity Futures Trading Commission (CFTC) regarding proposed regulation of perpetual swaps and 24/7 trading.

That was unexpected as decentralized platforms don’t tend to proactively engage with US regulators. Indeed, the concept of decentralization hasn’t been embraced (or perhaps even grasped) by American lawmakers.

But these are unprecedented times for Web3 regulation, and that’s a topic that Hyperliquid will need to grapple with at some point.

The platform doesn’t require any KYC for users to trade, although it is not available in the US, Canada’s Ontario and sanctioned regions such as Russia, North Korea, Iran, Cuba, and Syria. But with 180 other markets supported, you can be sure that regulators will come knocking sooner rather than later.

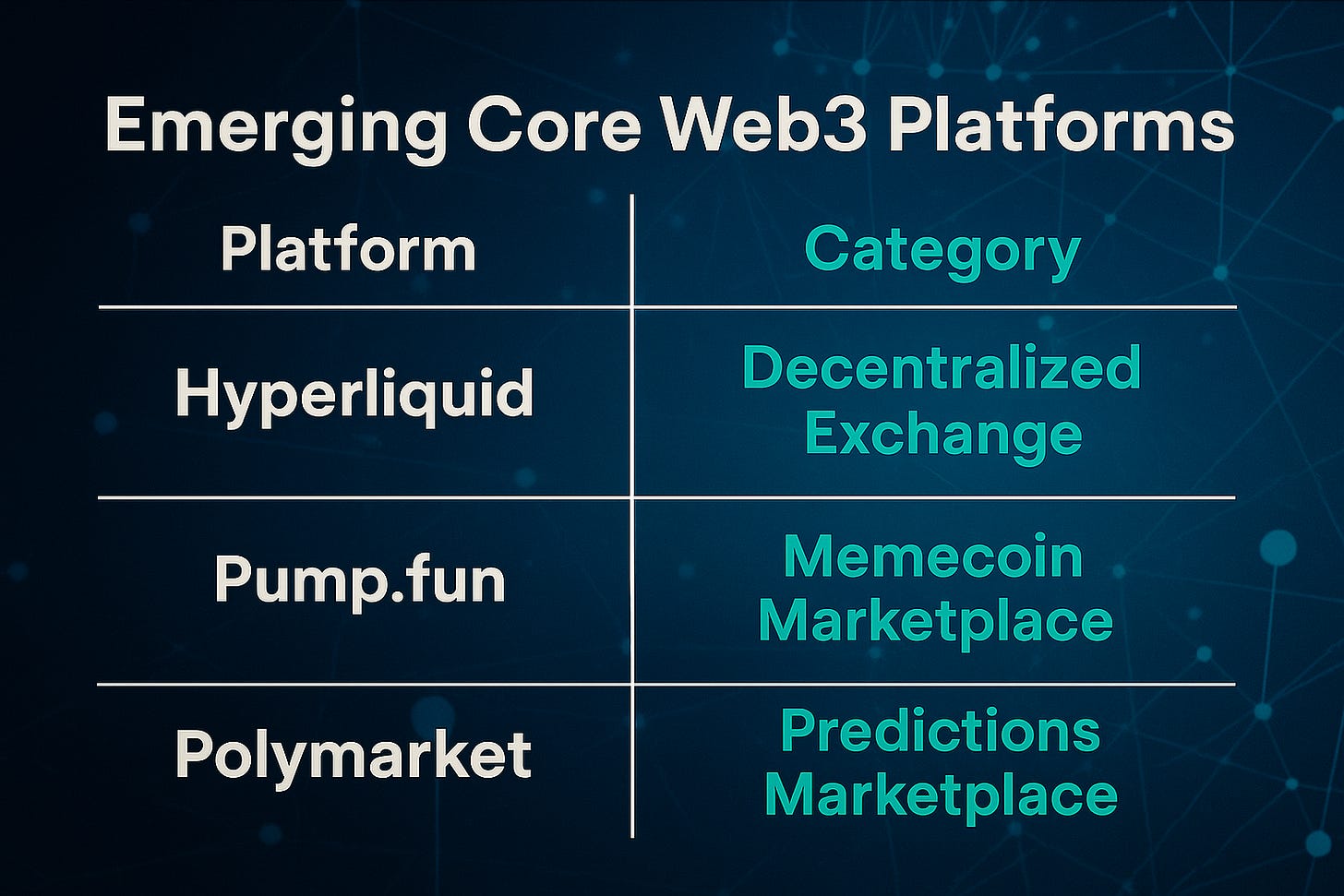

Hyperliquid is part of a new wave of decentralized platforms that now make up core Web3 services. We’ve written about the other two—memecoin marketplace Pump.fun and predictions marketplace Polymarket—and their rapid rises show how dynamic and fast-moving Web3 can be.

For now, we can expect Hyperliquid to expand the breadth of services that it offers. Its trading platform is based on its own proprietary blockchain, which was developed to combine the speed of trading on platforms like Binance with the transparency of Ethereum.

Armed with a war chest from its surging token, Hyperliquid is just getting started.

News bytes

Thailand has approved a five-year tax exemption on crypto gains—if the trades are on licensed exchanges

Eight major banks in South Korea are working on a stablecoin that will be pegged to the country’s won currency

Polymarket and rival predictions market platform Kalshi are both reported raising new capital at valuations of $1 billion

Exchange OKX could be the next major crypto company to go public through a US IPO

Coinbase secured a Markets in Crypto-Assets (MiCA) licence from Luxembourg’s CSSF, allowing it to offer regulated crypto services across all 27 EU member states

That’s all for this week!

Share your feedback, questions or requests via email to: sowhat@terminal3.io