Reddit shows Coca Cola how NFTs are done

The social network just hit an impressive 20M minted PFPs

GM,

This week we are looking at NFTs. Not apes, doodles, cats or punks, this is the world of corporate and company NFT rollouts and how they can be used to build and strengthen community.

The two might seem at odds given a precipitous drop in the NFT market, with collections like the Bored Ape Yacht Club down nearly 80% from 2021 highs, but a number of companies are showing how these digital assets can boost their communities and user bases in a new and innovative way.

We will see you again next Friday,

What’s going on?

Coca Cola is the latest mega brand to jump into NFTs after it unveiled a collection of seven pieces of digital artwork that remix classic work by artists including Vermeer, Munch and Van Gogh using the iconic Coca Cola glass bottle.

Despite partnering with Coinbase, reception has been sluggish with Coca Cola pulling in less than US$500,000 in sales by Wednesday. That barely pays the bill for project consultants and is minuscule for a company with annual revenue of US$43 billion. Ominously, secondary sale prices—a way to generate income after an initial launch—are already below the original mint price.

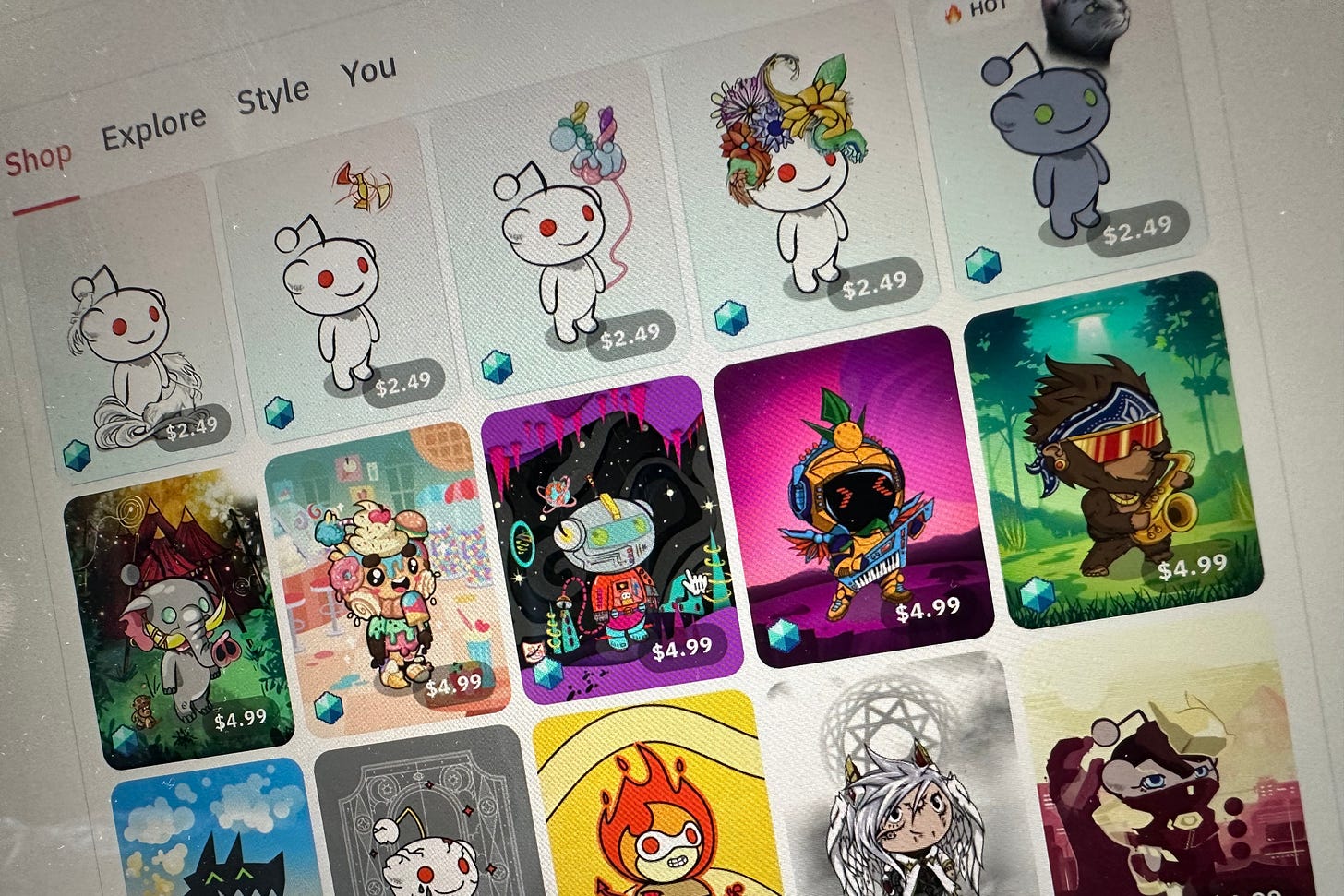

Also this week, Reddit reached 20 million mints of its PFP (profile pic) NFTs. That makes it one of the most successful NFT rollouts outside of core Web3 companies.

There’s a lot we can learn from both projects.

So What?

1. No utility, no point

We all remember Coca Cola-themed merch from football/soccer World Cups and other major events. My brothers and I (Jon here) would kick around their branded balls, or bother our mum to buy Olympic t-shirts. They had value and we used them. Coca Cola’s NFT artwork—while an innovative concept—doesn’t translate to real-life utility since owners can’t do anything with them.

What about ownership, you say? Yes, there’s been interest in NFTs as a digital art, particularly when paired with physical copies, but the market isn’t great right now. Sotheby’s was hit with a lawsuit this week from buyers who claim it deceptively marketed Bored Ape Yacht Club NFTs during a sale in 2021. The auction house made a then-record US$24.2 million selling 101 NFTs but prices have dropped significantly and the buyers say it undersold the risks.

Even when the market was hot, digital art was limited in usage. Display surfaces for pieces begin and end with a phone for most people. That leaves most buyers motivated by speculation. That’s not a recipe for long-term value, even for so-called blue chip collections like Bored Apes.

2. Reddit hits the mark

Reddit’s approach is different. As a social network, it already has a community where identity is key. What matters most for Reddit users is their karma (a community feedback score for their answers) and the networks they build through their posts and interests. The chance to customize identity with a PFP plays right into that existing experience.

Users can pick regular avatars but opting for NFTs adds further value because not only are the collections often designed by Reddit users—allowing the community itself to monetize their passion—and they can’t be taken away. Reddit’s API changes (which saw some popular apps killed off) reminded us that internet platforms hold all the power, but the NFTs will always belong to the user.

Importantly, Reddit made it easy to create a wallet and buy a PFP. The process is within the mobile app and it uses in-app purchases—no browser extensions or worry of gas fees. More sophisticated users can move their NFTs to external wallets, but that’s not required and less savvy buyers don’t fall at the first hurdle.

3. Community, community, community

Reddit isn’t alone in its approach. Starbucks could have taken the Coca Cola route but it tapped its community via its loyalty program. It is going beyond a regular rewards program to give its near-30 million members NFTs that unlock real-world experiences, ranging from mixology tutorials to trips overseas.

It, too, tapped into an existing user experience and enhanced it using digital ownership. NFTs alone don’t make a killer use case.

This remix of Steve Ballmer’s “developers” meme is perfect

At my previous startup (Gary here), we talked many companies out of NFT projects during the crypto bull market because there was either no utility to the digital artwork or no community that it would unlock. The brutal truth is that, right now, the digital collectibles market just isn’t that interesting. If you have a community, though, a thoughtfully-designed NFT program could take it to a new level as Reddit, Starbucks and others are showing.

News bytes

Singapore has released a regulatory framework for stablecoins—a topic we covered last week with PayPal’s PYUSD launch

The framework covers any stablecoin pegged to the Singaporean dollar or another G10 currency

They must hold at least SG$1 million (US$740,000) in base capital and provide redemption within five days

It is likely to encourage banks and other financial institutions to issue stablecoins

Embattled exchange Binance closed down its payments business that allowed fiat-to-crypto transactions

Others are taking advantage of Binance’s struggles, which includes SEC charges—rival exchange Bitgo raised US$100 million to fund acquisitions and an expanded regulation push

Prominent crypto media firm Coindesk laid off nearly half of its editorial staff as it waits on a deal to sell it from owner DCG, which is shoring up its balance sheet

The Indian Ministry of Electronics and Information Technology wants to allow users to digitally sign documents using crypto tokens in its new web browser—that’s despite the country not yet taking a position on the legal status of cryptocurrencies

That’s all for this week!

You can share your feedback, questions or requests via email to: sowhat@terminal.io